# Import all required libraries

# Data handling and manipulation

import pandas as pd

import numpy as np

# Implementing and selecting models

import statsmodels.api as sm

from sklearn.model_selection import train_test_split, cross_val_score, KFold

from itertools import combinations

from mlxtend.feature_selection import SequentialFeatureSelector as SFS

from sklearn.linear_model import LinearRegression

# For advanced visualizations

import matplotlib.pyplot as plt

import seaborn as sns

# Show computation time

import time

# Increase font size of all Seaborn plot elements

sns.set(font_scale = 1.25)

# Set Seaborn theme

sns.set_theme(style = "white")Regressions I

Lecture 7

University of Arizona

INFO 523 - Spring 2024

Warm up

Announcements

RQ 3 is due today, 11:59pm

HW 3 is due today, 11:59pm

Final project peer-review is Wed Apr 03

Setup

Regressions

Linear regression

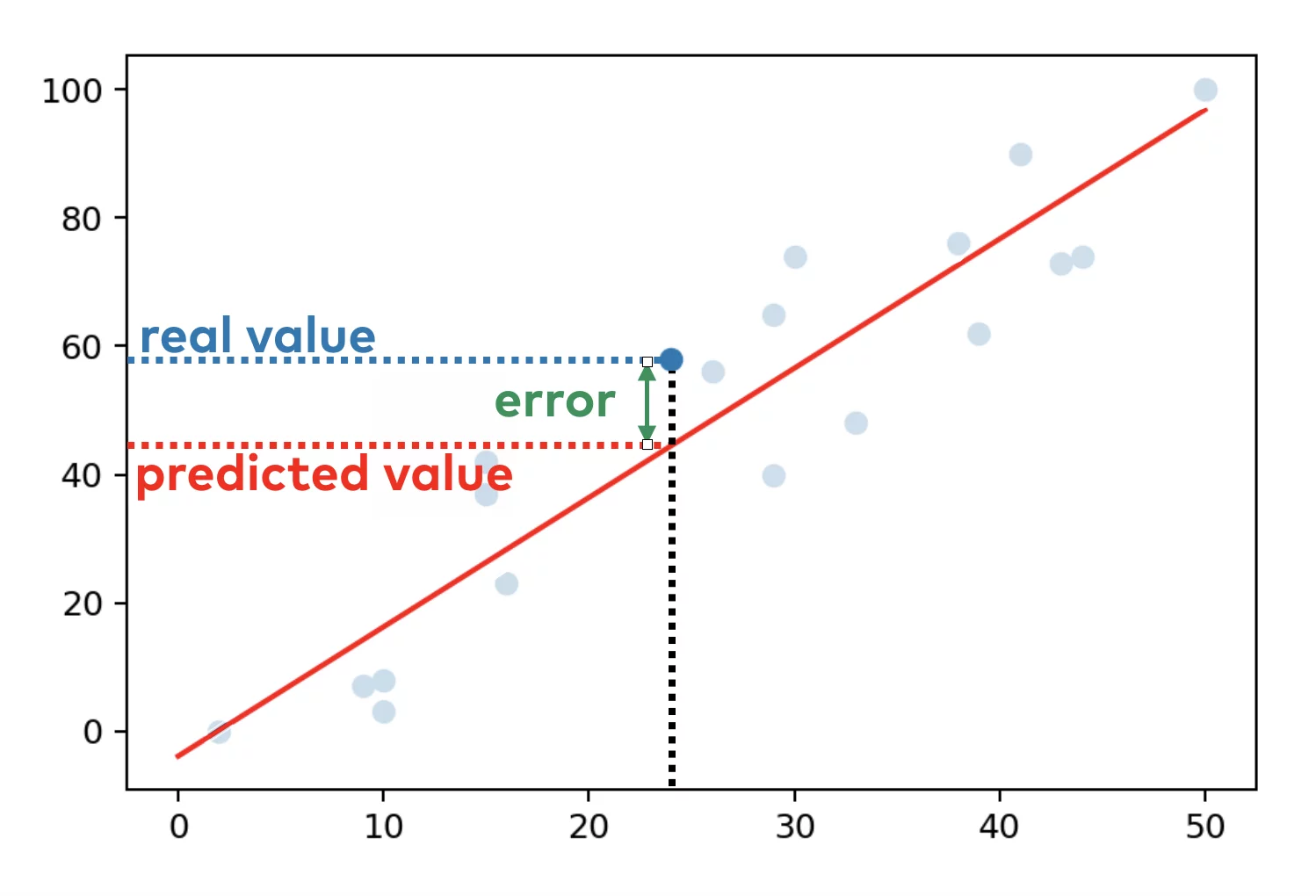

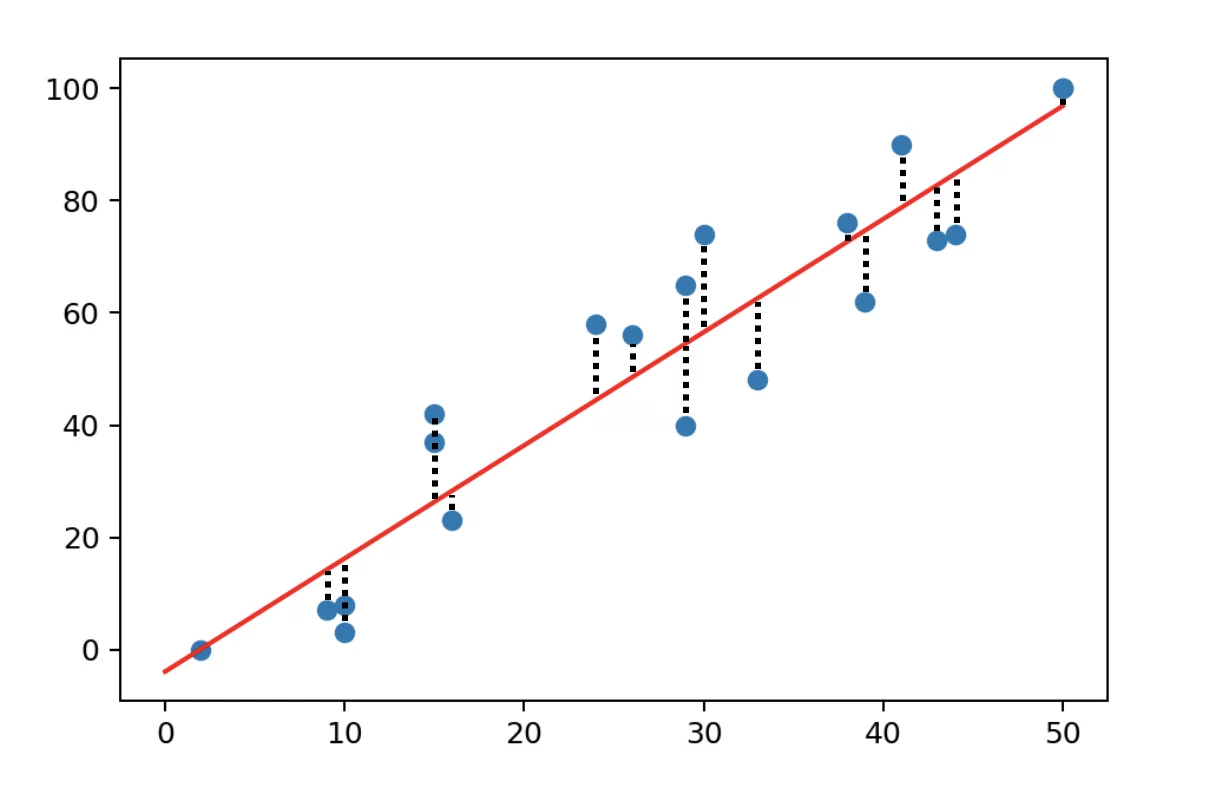

Objective: Minimize the sum of squared differences between observed and predicted.

Model structure:

Yi=β0+β1Xi+ϵi

Yi: Dependent/response variable

Xi: Independent/predictor variable

β0: y-intercept

β1: Slope

ϵi: Random error term, deviation of the real value from predicted

Assumptions: Linearity, independent residuals, constant variance (homoscedasticity), and normally distributed residuals.

Goodness of Fit: Assessed by R2, the proportion of variance in Y explained by X.

Statistical Significance: Tested by t-tests on the coefficients.

Confidence Intervals: Provide a range for the estimated coefficients.

Predictions: Use the model to predict Y for new X values.

Diagnostics: Check residuals for model assumption violations.

Sensitivity: Influenced by outliers which can skew the model.

Applications: Used across various fields for predictive modeling and data analysis.

Assumptions

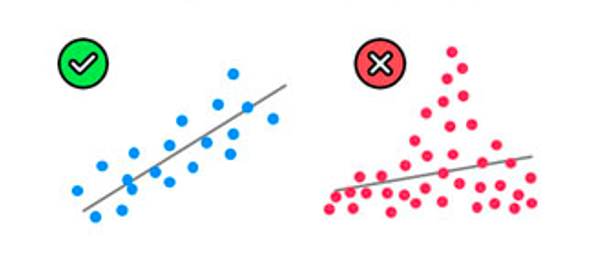

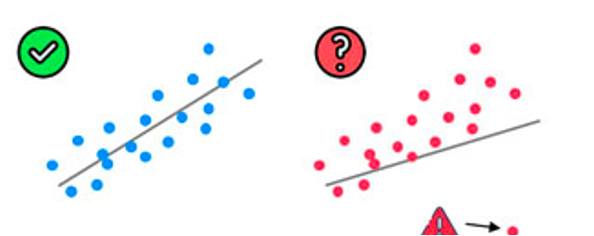

Linearity

(Linear relationship between Y ~ X)

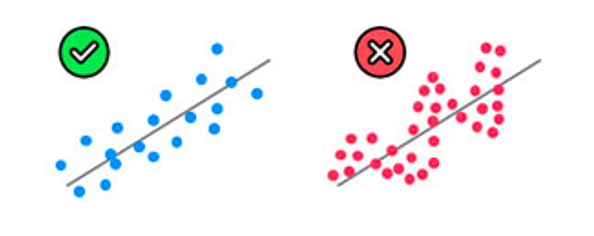

Homoscedasticity

(Equal variance among variables)

Multivartiate Normality

(Normally distributed residuals)

Independence

(Observations are independent)

Lack of Multicollinearity

(Predictors are not correlated)

Outlier check

(Technically not an assumption)

Ordinary Least Squares (OLS)

yi=β1xi1+β2xi2+⋯+βpxip+εi

- yi: Dependent variable for the i-th observation.

- β1,β2,…,βp: Coefficients representing the impact of each independent variable.

- xi1,xi1,…,xip: Independent variables for the i-th observation.

- ϵi: Error term for the i-th observation, indicating unexplained variance.

Assessing accuracy of coefficients

Two major methods:

- Standard errors (SE):

Indicate the precision of coefficient estimates; smaller values suggest more precise estimates.

Formula: σˉx≈σx√n

- Confidence Intervals:

Ranges constructed from standard errors that indicate where the true coefficient is likely to fall, typically at a 95% confidence level.

Derived from same method as p-values

Assessing accuracy of model

Four major methods:

- Mean square error (MSE): MSE of a predictor is calculated as the average of the squares of the errors, where the error is the difference between the actual value and the predicted value.

- R-squared (R2): Proportion of variance in the dependent variable explained by the model; closer to 1 indicates a better fit.

- Adjusted R-squared (R2adj): Modified R² that accounts for the number of predictors; useful for comparing models with different numbers of independent variables.

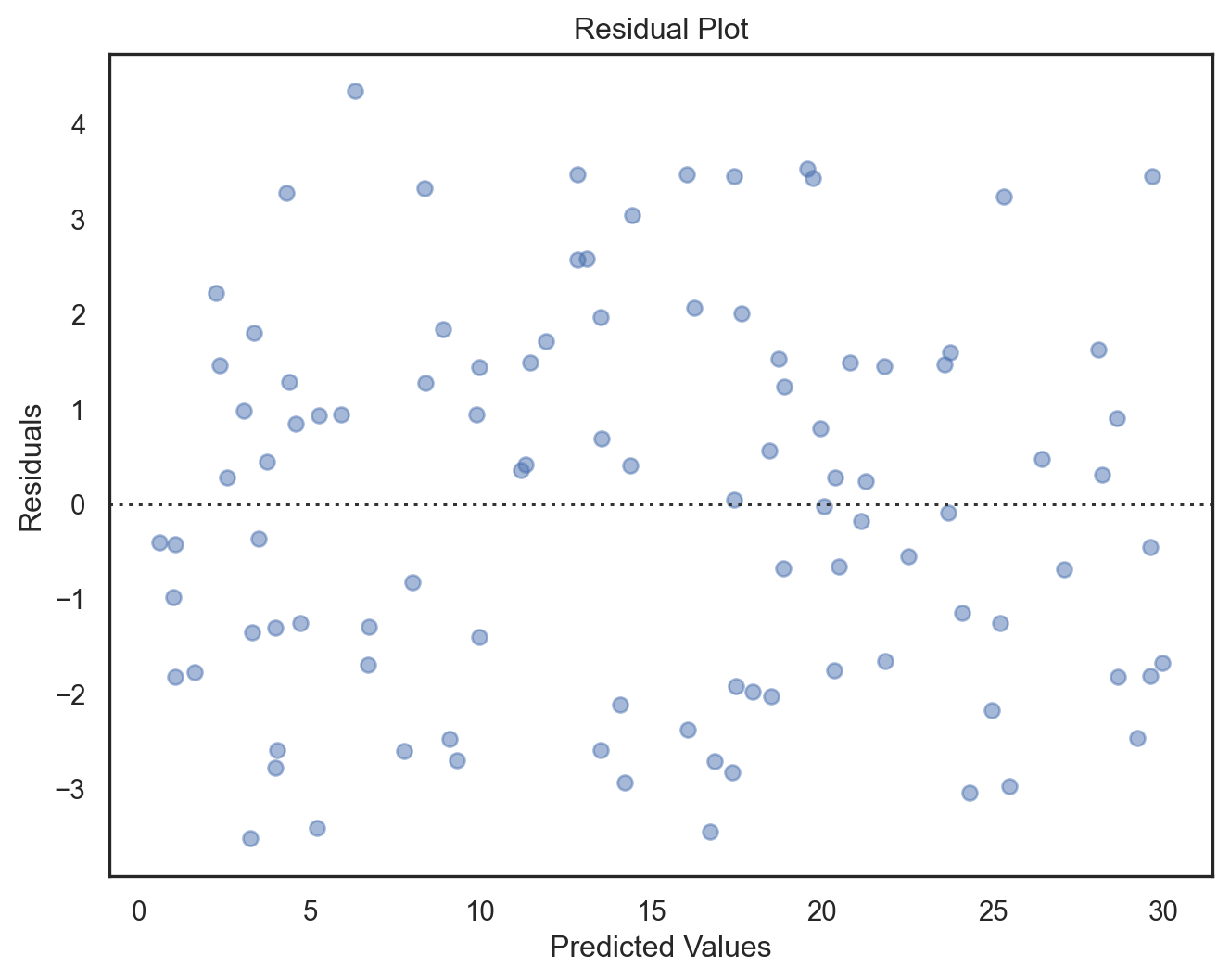

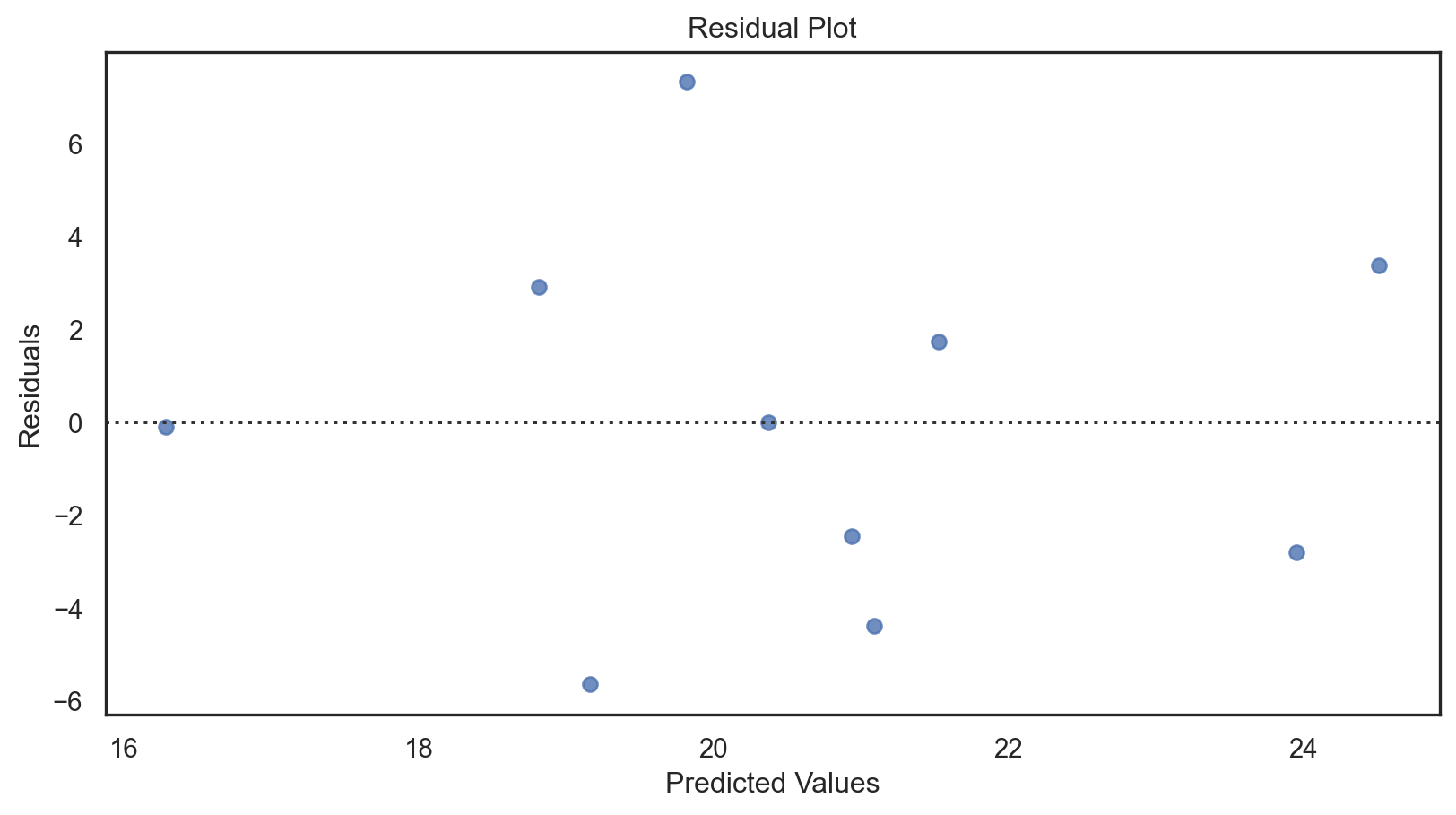

- Residual plots: Visual check for randomness in residuals; patterns may indicate model issues like non-linearity or heteroscedasticity.

In statistics, the mean squared error (MSE) or mean squared deviation (MSD) of an estimator measures the average of the squares of the errors—that is, the average squared difference between the estimated values and the actual value. The MSE either assesses the quality of a predictoror of an estimator.

Predictor

MSE=1n∑ni=1(yi−ˆyi)2

yi: the actual values

ˆyi: the predicted values

n: sample size

Define the residuals as ei=yi−fi(forming a vector e).

If ˉy is the observed mean:

ˉy=1n∑ni=1yi

then the variability of the data set can be measured with two sums of squares (SS) formulas:

RSS=∑ni=1(yi−ˆyi)2

TSS=∑ni=1(yi−ˉy)2

R-squared:

R2=1−RSSTSS

Formula R2=1−RSS/dfresTSS/dftot

Key points:

Penalizes Complexity: Adjusts for the number of terms in the model, penalizing the addition of irrelevant predictors.

Comparability: More reliable than R-squared for comparing models with different numbers of independent variables.

Value Range: Can be negative if the model is worse than using just the mean of the dependent variable, whereas R-squared is always between 0 and 1.

- dfres: degrees of freedom of the estimate of the population variance around the model

- dftot: degrees of freedom of the estimate of the population variance around the mean

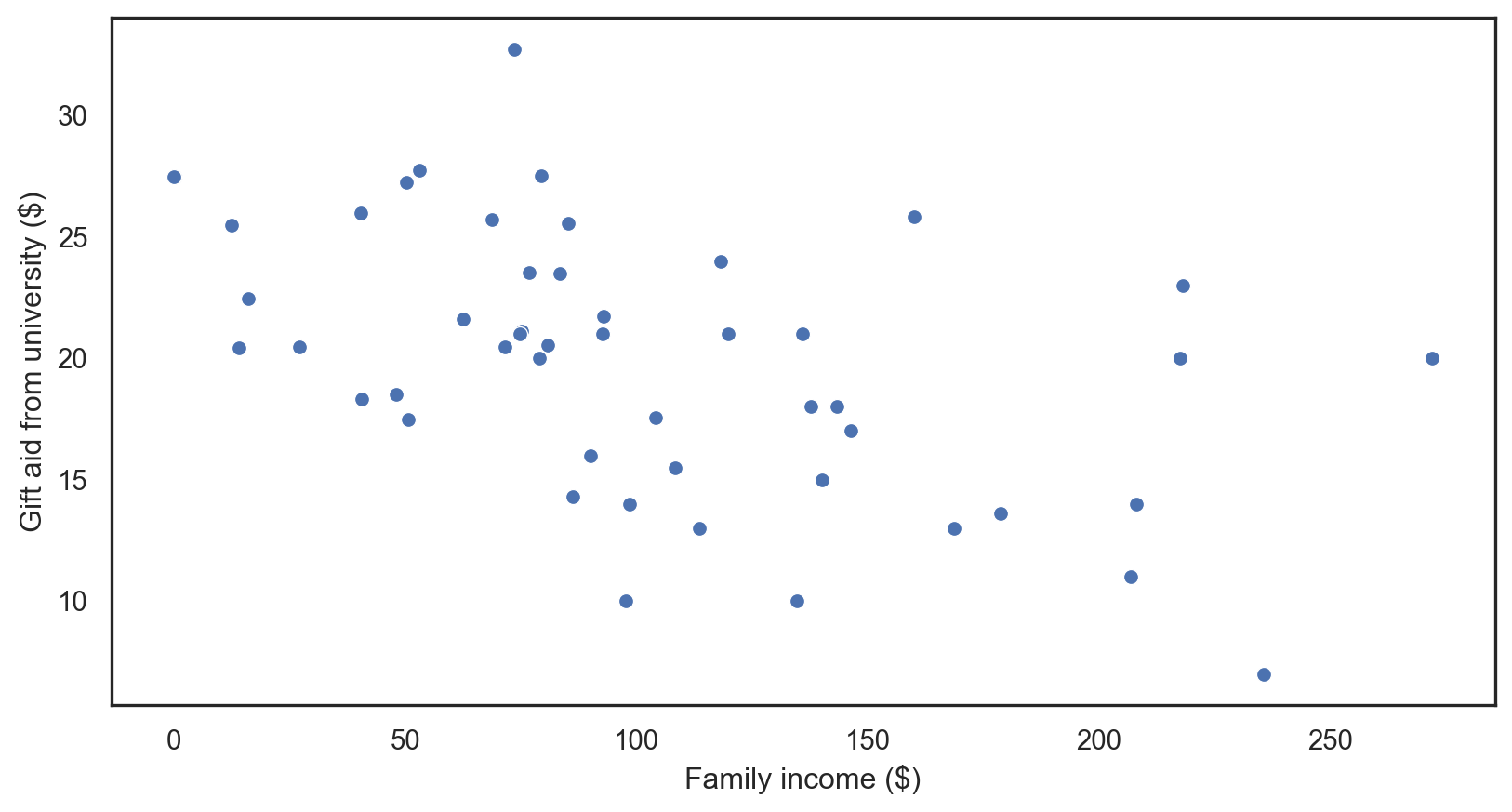

Our data

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 50 entries, 0 to 49

Data columns (total 3 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 family_income 50 non-null float64

1 gift_aid 50 non-null float64

2 price_paid 50 non-null float64

dtypes: float64(3)

memory usage: 1.3 KB| family_income | gift_aid | price_paid | |

|---|---|---|---|

| count | 50.000000 | 50.000000 | 50.000000 |

| mean | 101.778520 | 19.935560 | 19.544440 |

| std | 63.206451 | 5.460581 | 5.979759 |

| min | 0.000000 | 7.000000 | 8.530000 |

| 25% | 64.079000 | 16.250000 | 15.000000 |

| 50% | 88.061500 | 20.470000 | 19.500000 |

| 75% | 137.174000 | 23.515000 | 23.630000 |

| max | 271.974000 | 32.720000 | 35.000000 |

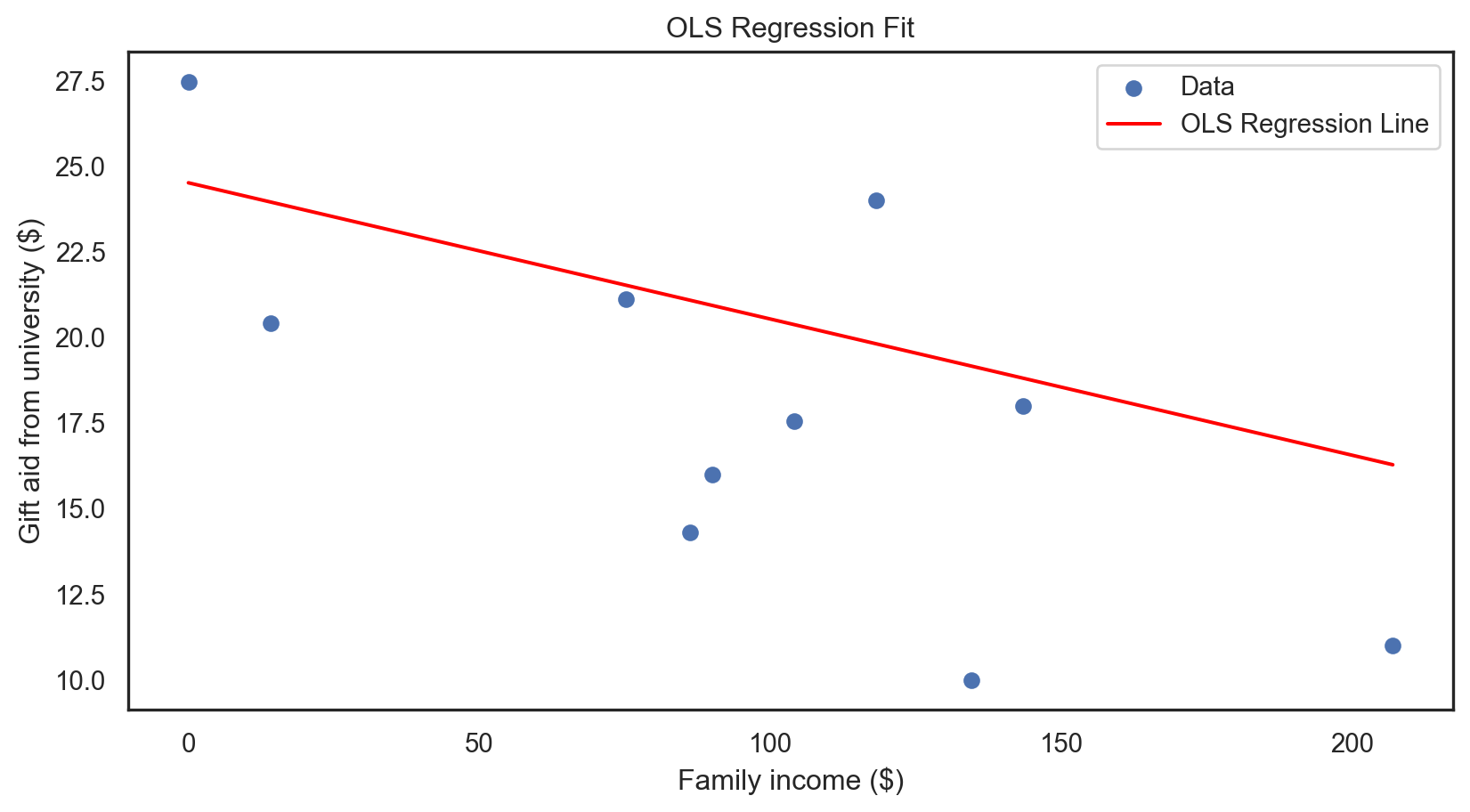

OLS regression: applied

Code

X = elmhurst['family_income'] # Independent variable y = elmhurst['gift_aid'] # Dependent variable X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42) X_train_with_const = sm.add_constant(X_train) model = sm.OLS(y_train, X_train_with_const).fit() model_summary2 = model.summary2() print(model_summary2)X = elmhurst['family_income'] # Independent variable y = elmhurst['gift_aid'] # Dependent variable X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42) X_train_with_const = sm.add_constant(X_train) model = sm.OLS(y_train, X_train_with_const).fit() model_summary2 = model.summary2() print(model_summary2)X = elmhurst['family_income'] # Independent variable y = elmhurst['gift_aid'] # Dependent variable X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42) X_train_with_const = sm.add_constant(X_train) model = sm.OLS(y_train, X_train_with_const).fit() model_summary2 = model.summary2() print(model_summary2)X = elmhurst['family_income'] # Independent variable y = elmhurst['gift_aid'] # Dependent variable X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42) X_train_with_const = sm.add_constant(X_train) model = sm.OLS(y_train, X_train_with_const).fit() model_summary2 = model.summary2() print(model_summary2)X = elmhurst['family_income'] # Independent variable y = elmhurst['gift_aid'] # Dependent variable X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42) X_train_with_const = sm.add_constant(X_train) model = sm.OLS(y_train, X_train_with_const).fit() model_summary2 = model.summary2() print(model_summary2)X = elmhurst['family_income'] # Independent variable y = elmhurst['gift_aid'] # Dependent variable X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42) X_train_with_const = sm.add_constant(X_train) model = sm.OLS(y_train, X_train_with_const).fit() model_summary2 = model.summary2() print(model_summary2)

Results: Ordinary least squares

=================================================================

Model: OLS Adj. R-squared: 0.205

Dependent Variable: gift_aid AIC: 241.3545

Date: 2024-04-25 15:09 BIC: 244.7323

No. Observations: 40 Log-Likelihood: -118.68

Df Model: 1 F-statistic: 11.05

Df Residuals: 38 Prob (F-statistic): 0.00197

R-squared: 0.225 Scale: 23.273

-----------------------------------------------------------------

Coef. Std.Err. t P>|t| [0.025 0.975]

-----------------------------------------------------------------

const 24.5170 1.4489 16.9216 0.0000 21.5839 27.4500

family_income -0.0398 0.0120 -3.3238 0.0020 -0.0640 -0.0156

-----------------------------------------------------------------

Omnibus: 0.057 Durbin-Watson: 2.277

Prob(Omnibus): 0.972 Jarque-Bera (JB): 0.249

Skew: 0.047 Prob(JB): 0.883

Kurtosis: 2.625 Condition No.: 230

=================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the

errors is correctly specified.Code

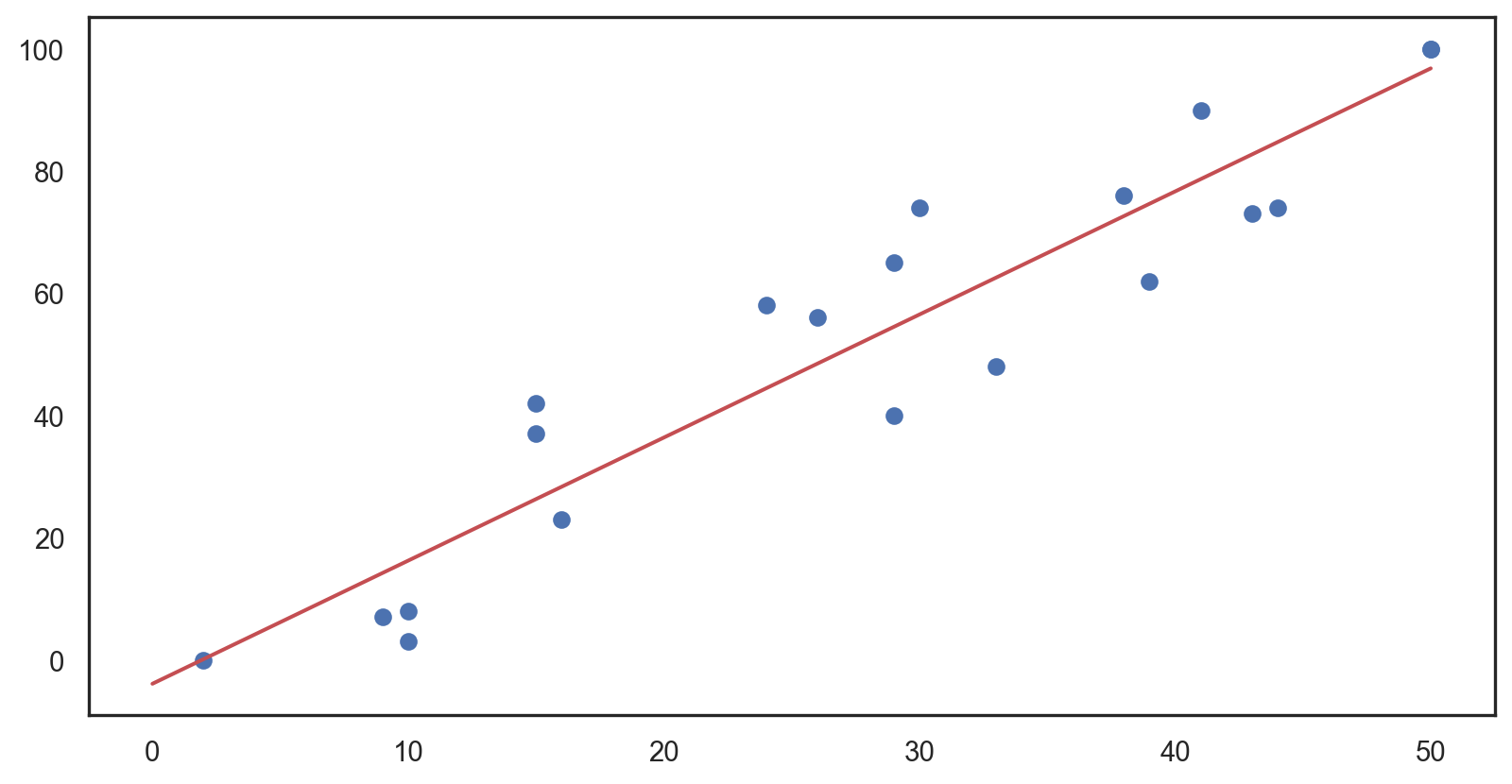

X_test_with_const = sm.add_constant(X_test) predictions = model.predict(X_test_with_const) residuals = y_test - predictions sns.residplot(x = predictions, y = residuals) plt.xlabel('Predicted Values') plt.ylabel('Residuals') plt.title('Residual Plot') plt.show()X_test_with_const = sm.add_constant(X_test) predictions = model.predict(X_test_with_const) residuals = y_test - predictions sns.residplot(x = predictions, y = residuals) plt.xlabel('Predicted Values') plt.ylabel('Residuals') plt.title('Residual Plot') plt.show()X_test_with_const = sm.add_constant(X_test) predictions = model.predict(X_test_with_const) residuals = y_test - predictions sns.residplot(x = predictions, y = residuals) plt.xlabel('Predicted Values') plt.ylabel('Residuals') plt.title('Residual Plot') plt.show()X_test_with_const = sm.add_constant(X_test) predictions = model.predict(X_test_with_const) residuals = y_test - predictions sns.residplot(x = predictions, y = residuals) plt.xlabel('Predicted Values') plt.ylabel('Residuals') plt.title('Residual Plot') plt.show()X_test_with_const = sm.add_constant(X_test) predictions = model.predict(X_test_with_const) residuals = y_test - predictions sns.residplot(x = predictions, y = residuals) plt.xlabel('Predicted Values') plt.ylabel('Residuals') plt.title('Residual Plot') plt.show()

Code

plt.scatter(X_test, y_test, label = 'Data') line_x = np.linspace(X_test.min(), X_test.max(), 100) line_y = model.predict(sm.add_constant(line_x)) plt.plot(line_x, line_y, color = 'red', label = 'OLS Regression Line') plt.xlabel("Family income ($)") plt.ylabel("Gift aid from university ($)") plt.title('OLS Regression Fit') plt.legend() plt.show()plt.scatter(X_test, y_test, label = 'Data') line_x = np.linspace(X_test.min(), X_test.max(), 100) line_y = model.predict(sm.add_constant(line_x)) plt.plot(line_x, line_y, color = 'red', label = 'OLS Regression Line') plt.xlabel("Family income ($)") plt.ylabel("Gift aid from university ($)") plt.title('OLS Regression Fit') plt.legend() plt.show()plt.scatter(X_test, y_test, label = 'Data') line_x = np.linspace(X_test.min(), X_test.max(), 100) line_y = model.predict(sm.add_constant(line_x)) plt.plot(line_x, line_y, color = 'red', label = 'OLS Regression Line') plt.xlabel("Family income ($)") plt.ylabel("Gift aid from university ($)") plt.title('OLS Regression Fit') plt.legend() plt.show()plt.scatter(X_test, y_test, label = 'Data') line_x = np.linspace(X_test.min(), X_test.max(), 100) line_y = model.predict(sm.add_constant(line_x)) plt.plot(line_x, line_y, color = 'red', label = 'OLS Regression Line') plt.xlabel("Family income ($)") plt.ylabel("Gift aid from university ($)") plt.title('OLS Regression Fit') plt.legend() plt.show()plt.scatter(X_test, y_test, label = 'Data') line_x = np.linspace(X_test.min(), X_test.max(), 100) line_y = model.predict(sm.add_constant(line_x)) plt.plot(line_x, line_y, color = 'red', label = 'OLS Regression Line') plt.xlabel("Family income ($)") plt.ylabel("Gift aid from university ($)") plt.title('OLS Regression Fit') plt.legend() plt.show()

Multiple regression

Multiple regression

Multiple Predictors: more than one predictor variable to predict a response variable.

Model Form: Y=β0+β1X1+β2X2+⋯+βnXn+ϵ , where Y is the response variable, X1,X2,...,Xn are predictor variables, βs are coefficients, and ϵ is the error term.

Coefficient Interpretation: Each coefficient represents the change in the response variable for one unit change in the predictor, holding other predictors constant.

Assumptions: Includes linearity, no perfect multicollinearity, homoscedasticity, independence of errors, and normality of residuals.

Adjusted R-squared: Used to determine the model’s explanatory power, adjusting for the number of predictors.

Multicollinearity Concerns: High correlation between predictor variables can distort the model and make coefficient estimates unreliable.

Interaction Effects: Can be included to see if the effect of one predictor on the response variable depends on another predictor.

Our data

How do factors like debt-to-income ratio, bankruptcy history, and loan term affect the interest rate of a loan?

| emp_title | emp_length | state | homeownership | annual_income | verified_income | debt_to_income | annual_income_joint | verification_income_joint | debt_to_income_joint | ... | sub_grade | issue_month | loan_status | initial_listing_status | disbursement_method | balance | paid_total | paid_principal | paid_interest | paid_late_fees | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | global config engineer | 3.0 | NJ | MORTGAGE | 90000.0 | Verified | 18.01 | NaN | NaN | NaN | ... | C3 | Mar-2018 | Current | whole | Cash | 27015.86 | 1999.33 | 984.14 | 1015.19 | 0.0 |

| 1 | warehouse office clerk | 10.0 | HI | RENT | 40000.0 | Not Verified | 5.04 | NaN | NaN | NaN | ... | C1 | Feb-2018 | Current | whole | Cash | 4651.37 | 499.12 | 348.63 | 150.49 | 0.0 |

| 2 | assembly | 3.0 | WI | RENT | 40000.0 | Source Verified | 21.15 | NaN | NaN | NaN | ... | D1 | Feb-2018 | Current | fractional | Cash | 1824.63 | 281.80 | 175.37 | 106.43 | 0.0 |

| 3 | customer service | 1.0 | PA | RENT | 30000.0 | Not Verified | 10.16 | NaN | NaN | NaN | ... | A3 | Jan-2018 | Current | whole | Cash | 18853.26 | 3312.89 | 2746.74 | 566.15 | 0.0 |

| 4 | security supervisor | 10.0 | CA | RENT | 35000.0 | Verified | 57.96 | 57000.0 | Verified | 37.66 | ... | C3 | Mar-2018 | Current | whole | Cash | 21430.15 | 2324.65 | 1569.85 | 754.80 | 0.0 |

5 rows × 55 columns

| Variable | Description |

|---|---|

interest_rate |

Interest rate on the loan, in an annual percentage. |

verified_income |

Borrower’s income verification: Verified, Source Verified, and Not Verified. |

debt_to_income |

Debt-to-income ratio, which is the percentage of total debt of the borrower divided by their total income. |

credit_util |

The fraction of available credit utilized. |

bankruptcy |

An indicator variable for whether the borrower has a past bankruptcy in their record. This variable takes a value of 1 if the answer is yes and 0 if the answer is no. |

term |

The length of the loan, in months. |

issue_month |

The month and year the loan was issued. |

credit_checks |

Number of credit checks in the last 12 months. |

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 10000 entries, 0 to 9999

Data columns (total 55 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 emp_title 9167 non-null object

1 emp_length 9183 non-null float64

2 state 10000 non-null object

3 homeownership 10000 non-null object

4 annual_income 10000 non-null float64

5 verified_income 10000 non-null object

6 debt_to_income 9976 non-null float64

7 annual_income_joint 1495 non-null float64

8 verification_income_joint 1455 non-null object

9 debt_to_income_joint 1495 non-null float64

10 delinq_2y 10000 non-null int64

11 months_since_last_delinq 4342 non-null float64

12 earliest_credit_line 10000 non-null int64

13 inquiries_last_12m 10000 non-null int64

14 total_credit_lines 10000 non-null int64

15 open_credit_lines 10000 non-null int64

16 total_credit_limit 10000 non-null int64

17 total_credit_utilized 10000 non-null int64

18 num_collections_last_12m 10000 non-null int64

19 num_historical_failed_to_pay 10000 non-null int64

20 months_since_90d_late 2285 non-null float64

21 current_accounts_delinq 10000 non-null int64

22 total_collection_amount_ever 10000 non-null int64

23 current_installment_accounts 10000 non-null int64

24 accounts_opened_24m 10000 non-null int64

25 months_since_last_credit_inquiry 8729 non-null float64

26 num_satisfactory_accounts 10000 non-null int64

27 num_accounts_120d_past_due 9682 non-null float64

28 num_accounts_30d_past_due 10000 non-null int64

29 num_active_debit_accounts 10000 non-null int64

30 total_debit_limit 10000 non-null int64

31 num_total_cc_accounts 10000 non-null int64

32 num_open_cc_accounts 10000 non-null int64

33 num_cc_carrying_balance 10000 non-null int64

34 num_mort_accounts 10000 non-null int64

35 account_never_delinq_percent 10000 non-null float64

36 tax_liens 10000 non-null int64

37 public_record_bankrupt 10000 non-null int64

38 loan_purpose 10000 non-null object

39 application_type 10000 non-null object

40 loan_amount 10000 non-null int64

41 term 10000 non-null int64

42 interest_rate 10000 non-null float64

43 installment 10000 non-null float64

44 grade 10000 non-null object

45 sub_grade 10000 non-null object

46 issue_month 10000 non-null object

47 loan_status 10000 non-null object

48 initial_listing_status 10000 non-null object

49 disbursement_method 10000 non-null object

50 balance 10000 non-null float64

51 paid_total 10000 non-null float64

52 paid_principal 10000 non-null float64

53 paid_interest 10000 non-null float64

54 paid_late_fees 10000 non-null float64

dtypes: float64(17), int64(25), object(13)

memory usage: 4.2+ MB| emp_length | annual_income | debt_to_income | annual_income_joint | debt_to_income_joint | delinq_2y | months_since_last_delinq | earliest_credit_line | inquiries_last_12m | total_credit_lines | ... | public_record_bankrupt | loan_amount | term | interest_rate | installment | balance | paid_total | paid_principal | paid_interest | paid_late_fees | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 9183.000000 | 1.000000e+04 | 9976.000000 | 1.495000e+03 | 1495.000000 | 10000.00000 | 4342.000000 | 10000.00000 | 10000.00000 | 10000.000000 | ... | 10000.000000 | 10000.000000 | 10000.000000 | 10000.000000 | 10000.000000 | 10000.000000 | 10000.000000 | 10000.000000 | 10000.000000 | 10000.000000 |

| mean | 5.930306 | 7.922215e+04 | 19.308192 | 1.279146e+05 | 19.979304 | 0.21600 | 36.760709 | 2001.29000 | 1.95820 | 22.679600 | ... | 0.123800 | 16361.922500 | 43.272000 | 12.427524 | 476.205323 | 14458.916610 | 2494.234773 | 1894.448466 | 599.666781 | 0.119516 |

| std | 3.703734 | 6.473429e+04 | 15.004851 | 7.016838e+04 | 8.054781 | 0.68366 | 21.634939 | 7.79551 | 2.38013 | 11.885439 | ... | 0.337172 | 10301.956759 | 11.029877 | 5.001105 | 294.851627 | 9964.561865 | 3958.230365 | 3884.407175 | 517.328062 | 1.813468 |

| min | 0.000000 | 0.000000e+00 | 0.000000 | 1.920000e+04 | 0.320000 | 0.00000 | 1.000000 | 1963.00000 | 0.00000 | 2.000000 | ... | 0.000000 | 1000.000000 | 36.000000 | 5.310000 | 30.750000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 25% | 2.000000 | 4.500000e+04 | 11.057500 | 8.683350e+04 | 14.160000 | 0.00000 | 19.000000 | 1997.00000 | 0.00000 | 14.000000 | ... | 0.000000 | 8000.000000 | 36.000000 | 9.430000 | 256.040000 | 6679.065000 | 928.700000 | 587.100000 | 221.757500 | 0.000000 |

| 50% | 6.000000 | 6.500000e+04 | 17.570000 | 1.130000e+05 | 19.720000 | 0.00000 | 34.000000 | 2003.00000 | 1.00000 | 21.000000 | ... | 0.000000 | 14500.000000 | 36.000000 | 11.980000 | 398.420000 | 12379.495000 | 1563.300000 | 984.990000 | 446.140000 | 0.000000 |

| 75% | 10.000000 | 9.500000e+04 | 25.002500 | 1.515455e+05 | 25.500000 | 0.00000 | 53.000000 | 2006.00000 | 3.00000 | 29.000000 | ... | 0.000000 | 24000.000000 | 60.000000 | 15.050000 | 644.690000 | 20690.182500 | 2616.005000 | 1694.555000 | 825.420000 | 0.000000 |

| max | 10.000000 | 2.300000e+06 | 469.090000 | 1.100000e+06 | 39.980000 | 13.00000 | 118.000000 | 2015.00000 | 29.00000 | 87.000000 | ... | 3.000000 | 40000.000000 | 60.000000 | 30.940000 | 1566.590000 | 40000.000000 | 41630.443684 | 40000.000000 | 4216.440000 | 52.980000 |

8 rows × 42 columns

Our data: preprocessed

loans['credit_util'] = loans['total_credit_utilized'] / loans['total_credit_limit']

loans['bankruptcy'] = (loans['public_record_bankrupt'] != 0).astype(int)

loans['verified_income'] = loans['verified_income'].astype('category').cat.remove_unused_categories()

loans = loans.rename(columns = {'inquiries_last_12m': 'credit_checks'})

loans = loans[['interest_rate', 'verified_income', 'debt_to_income', 'credit_util', 'bankruptcy', 'term', 'credit_checks', 'issue_month']]Multiple regression: applied

Code

X = loans[['verified_income', 'debt_to_income', 'credit_util', 'bankruptcy', 'term', 'credit_checks', 'issue_month']]

y = loans['interest_rate']

X = pd.get_dummies(X, columns = ['verified_income', 'issue_month'], drop_first = True)

X.fillna(0, inplace=True)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42)

X_train_with_const = sm.add_constant(X_train)

X_test_with_const = sm.add_constant(X_test)

X_train_with_const = X_train_with_const.astype(int)

X_test_with_const = X_test_with_const.astype(int)

model = sm.OLS(y_train, X_train_with_const).fit()

model_summary2 = model.summary2()

print(model_summary2) Results: Ordinary least squares

==============================================================================

Model: OLS Adj. R-squared: 0.191

Dependent Variable: interest_rate AIC: 46653.7930

Date: 2024-04-25 15:09 BIC: 46723.6650

No. Observations: 8000 Log-Likelihood: -23317.

Df Model: 9 F-statistic: 210.4

Df Residuals: 7990 Prob (F-statistic): 0.00

R-squared: 0.192 Scale: 19.937

------------------------------------------------------------------------------

Coef. Std.Err. t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 4.0713 0.2319 17.5583 0.0000 3.6167 4.5258

debt_to_income 0.0330 0.0033 9.8715 0.0000 0.0265 0.0396

credit_util 3.0409 0.4077 7.4585 0.0000 2.2417 3.8401

bankruptcy 0.5811 0.1543 3.7659 0.0002 0.2786 0.8836

term 0.1445 0.0046 31.5795 0.0000 0.1356 0.1535

credit_checks 0.2122 0.0211 10.0534 0.0000 0.1708 0.2535

verified_income_Source Verified 1.0041 0.1150 8.7304 0.0000 0.7787 1.2296

verified_income_Verified 2.4460 0.1355 18.0457 0.0000 2.1803 2.7117

issue_month_Jan-2018 -0.0778 0.1254 -0.6204 0.5350 -0.3236 0.1680

issue_month_Mar-2018 -0.0178 0.1233 -0.1445 0.8851 -0.2596 0.2239

------------------------------------------------------------------------------

Omnibus: 762.745 Durbin-Watson: 1.958

Prob(Omnibus): 0.000 Jarque-Bera (JB): 1001.147

Skew: 0.820 Prob(JB): 0.000

Kurtosis: 3.562 Condition No.: 398

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is

correctly specified.Code

X_test_with_const = sm.add_constant(X_test)

predictions = model.predict(X_test_with_const)

predictions = pd.to_numeric(predictions, errors='coerce')

residuals = y_test - predictions

residuals = pd.to_numeric(residuals, errors='coerce').fillna(0)

# Plotting the residuals

sns.residplot(x = predictions, y = residuals)

plt.xlabel('Predicted Values')

plt.ylabel('Residuals')

plt.title('Residual Plot')

plt.show()

Model optimization

Three major methods:

- AIC (Akaike Information Criterion): a measure of the relative quality of a statistical model for a given set of data. Lower and fewer parameters = better.

- AIC=2k−2ln(L), where k is the number of parameters, and L is the likelihood of the model.

- BIC (Bayesian Information Criterion): a criterion for model selection based on the likelihood of the model. Lower and fewer parameters = better.

- BIC=kln(n)−2ln(L), where k is the number of parameters, n is the sample size, and L is the likelihood of the model

- Cross-Validation: a statistical method used for assessing how the results of a predictive model will generalize to an independent data set.

- Most common method is k-Fold Cross Validation

Pros:

Balanced Approach: AIC balances model fit with complexity, reducing overfitting.

Comparative Utility: Suitable for comparing models on the same dataset.

Widespread Acceptance: Commonly used and recognized in statistical analysis.

Versatile: Applicable across various types of statistical models.

Cons:

Relative Measurement: Only provides a comparative metric and doesn’t indicate absolute model quality.

Risk of Underfitting: Penalizing complex models may lead to underfitting.

Sample Size Sensitivity: Its effectiveness can vary with the size of the dataset.

Assumption of Large Sample: Infinite sample size assumption is impractical.

No Probabilistic Interpretation: Lacks a direct probabilistic meaning, unlike some other statistical measures.

Pros:

Penalizes Complexity: Penalizes complexity, preventing overfitting.

Good for Large Data: The penalty term is more significant in larger datasets.

Model Comparison: Useful for comparing different models on the same dataset.

Widely Recognized: Commonly used in statistical model selection.

Cons:

Relative, Not Absolute: Only provides a comparative metric and doesn’t indicate absolute model quality.

Can Favor Simpler Models: Penalizing complex models may lead to underfitting.

Sample Size Dependent: The effectiveness of BIC is influenced by sample size.

Assumes Correct Model is in Set: Assumes that the true model is given.

Lacks Probabilistic Meaning: Lacks a direct probabilistic meaning, unlike some other statistical measures.

Pros:

Robustness: Provides a more accurate measure of out-of-sample accuracy.

Prevents Overfitting: Helps in detecting overfitting by evaluating model performance on unseen data.

Versatile: Can be used with any predictive modeling technique.

Tuning Hyperparameters: Useful for selecting the best model hyperparameters.

Cons:

Computationally Intensive: Can be slow with large datasets and complex models.

Data Requirements: Requires a sufficient amount of data to partition into meaningful subsets.

Variance: Results can be sensitive to the way in which data is divided.

No Single Best Model: only provides an estimation of how well a model type will perform.

Model selection

Model selection

The task of selecting a model from among various candidates on the basis of performance criterion to choose the best one.

Two major methods:

- Best subset selection: Evaluate all combinations, choose by a criterion - e.g., lowest RSS or highest R2adj

- Stepwise selection: Forward Selection or Backward Selection

Best subset selection

Definition

Best Subset Selection is a statistical method used in regression analysis to select a subset of predictors that provides the best fit for the response variable.

It involves:

Considering All Possible Predictor Subsets: For p predictors, all possible combinations (totaling 2p) of these predictors are considered.

Fitting a Model for Each Subset: A regression model is fitted for each subset of predictors.

Selecting the Best Model: The best model is selected based on a criterion that balances fit and complexity, such as the lowest Residual Sum of Squares (RSS) or the highest R2adj (or AIC, BIC).

For each subset, the model is given by:

Y=β0+∑i∈SβiXi+ϵ

Y: Response variable.

β0: Intercept.

βi: Coefficients for predictors.

Xi: Predictor variables.

ϵ: Error term.

S: Set of indices of selected predictors.

The quality of each model is assessed using a criterion like:

RSS=∑ni=1(yi−ˆyi)2

…or R2adj,AIC,BIC

Pros:

Comprehensive Approach: Evaluates all possible combinations of predictors, ensuring a thorough search.

Flexibility: Can be used with various selection criteria and types of regression models.

Intuitive: Provides a clear framework for model selection.

Cons:

Computational Intensity: The number of models to evaluate grows exponentially with the number of predictors, making it computationally demanding.

Overfitting Risk: May lead to overfit models, especially when the number of observations is not significantly larger than the number of predictors.

Model Selection Complexity: Requires careful choice and interpretation of model selection criteria to balance between model fit and complexity.

Stepwise selection (both types)

Definition

Stepwise selection is a method used in regression analysis to select predictor variables. There are two main types:

Forward Selection:

Starts with no predictor variables in the model.

Iteratively adds the variable that provides the most significant model improvement.

Continues until no significant improvement is made by adding more variables.

Backward Selection:

Begins with all candidate predictor variables.

Iteratively removes the least significant variable (that least worsens the model).

Continues until removing more variables significantly worsens the model.

The criteria for adding or removing a variable are usually based on statistical tests like the F-test or p-values:

Forward selection (adding a variable)

F=(RSS0−RSS1)/p1RSS1/(n−p0−1)

- RSS0 is the Residual Sum of Squares of the current model.

- RSS1 is the Residual Sum of Squares with the additional variable.

- p1 is the number of predictors in the new model.

- n is the number of observations.

- p0 is the number of predictors in the current model.

Backward selection (removing a variable)

Similar criteria but in reverse, considering the increase in RSS or the p-values of the coefficients.

Pros:

Simplicity: More straightforward and computationally less intensive than Best Subset Selection.

Flexibility: Can be adapted to various criteria for entering and removing variables.

Practical: Useful with multicollinearity and large sets of potential predictors.

Cons:

Arbitrary Choices: Depends on the order of variables and the specific entry and removal criteria.

Local Optima: Might not find the best possible model as it doesn’t evaluate all possible combinations.

Overfitting Risk: Especially in datasets with many variables relative to the number of observations.

Statistical Issues: Stepwise methods can inflate the significance of variables and do not account for the search process in assessing the fit.

Best Subset Selection: applied

Code

X = loans[['verified_income', 'debt_to_income', 'credit_util', 'bankruptcy', 'term', 'credit_checks', 'issue_month']]

y = loans['interest_rate']

X = pd.get_dummies(X, columns = ['verified_income', 'issue_month'], drop_first = True)

X.fillna(0, inplace=True)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42)

X_train_with_const = sm.add_constant(X_train)

X_test_with_const = sm.add_constant(X_test)

X_train_with_const = X_train_with_const.astype(int)

X_test_with_const = X_test_with_const.astype(int)

model = sm.OLS(y_train, X_train_with_const).fit()

model_summary2 = model.summary2()

print(model_summary2) Results: Ordinary least squares

==============================================================================

Model: OLS Adj. R-squared: 0.191

Dependent Variable: interest_rate AIC: 46653.7930

Date: 2024-04-25 15:09 BIC: 46723.6650

No. Observations: 8000 Log-Likelihood: -23317.

Df Model: 9 F-statistic: 210.4

Df Residuals: 7990 Prob (F-statistic): 0.00

R-squared: 0.192 Scale: 19.937

------------------------------------------------------------------------------

Coef. Std.Err. t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 4.0713 0.2319 17.5583 0.0000 3.6167 4.5258

debt_to_income 0.0330 0.0033 9.8715 0.0000 0.0265 0.0396

credit_util 3.0409 0.4077 7.4585 0.0000 2.2417 3.8401

bankruptcy 0.5811 0.1543 3.7659 0.0002 0.2786 0.8836

term 0.1445 0.0046 31.5795 0.0000 0.1356 0.1535

credit_checks 0.2122 0.0211 10.0534 0.0000 0.1708 0.2535

verified_income_Source Verified 1.0041 0.1150 8.7304 0.0000 0.7787 1.2296

verified_income_Verified 2.4460 0.1355 18.0457 0.0000 2.1803 2.7117

issue_month_Jan-2018 -0.0778 0.1254 -0.6204 0.5350 -0.3236 0.1680

issue_month_Mar-2018 -0.0178 0.1233 -0.1445 0.8851 -0.2596 0.2239

------------------------------------------------------------------------------

Omnibus: 762.745 Durbin-Watson: 1.958

Prob(Omnibus): 0.000 Jarque-Bera (JB): 1001.147

Skew: 0.820 Prob(JB): 0.000

Kurtosis: 3.562 Condition No.: 398

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is

correctly specified.def best_subset_selection(X, y):

results = []

for k in range(1, len(X.columns) + 1):

for combo in combinations(X.columns, k):

X_subset = sm.add_constant(X[list(combo)].astype(int))

model = sm.OLS(y, X_subset).fit()

results.append({'model': model, 'predictors': combo})

return results

subset_results = best_subset_selection(X_train, y_train)best_aic = np.inf

best_model_1 = None

for result in subset_results:

if result['model'].aic < best_aic:

best_aic = result['model'].aic

best_model_1 = result

print("Best Model Predictors:", best_model_1['predictors'])

print("Best Model AIC:", best_aic.round(2))Best Model Predictors: ('debt_to_income', 'credit_util', 'bankruptcy', 'term', 'credit_checks', 'verified_income_Source Verified', 'verified_income_Verified')

Best Model AIC: 46650.23best_bic = np.inf

best_model_2 = None

for result in subset_results:

if result['model'].bic < best_bic:

best_bic = result['model'].bic

best_model_2 = result

print("Best Model Predictors:", best_model_2['predictors'])

print("Best Model BIC:", best_bic.round(2))Best Model Predictors: ('debt_to_income', 'credit_util', 'bankruptcy', 'term', 'credit_checks', 'verified_income_Source Verified', 'verified_income_Verified')

Best Model BIC: 46706.13best_r_sq_adj = -np.inf

best_model_3 = None

for result in subset_results:

if result['model'].rsquared_adj > best_r_sq_adj:

best_r_sq_adj = result['model'].rsquared_adj

best_model_3 = result

print("Best Model Predictors:", best_model_3['predictors'])

print("Best Model Adjusted R-squared:", best_r_sq_adj.round(2))Best Model Predictors: ('debt_to_income', 'credit_util', 'bankruptcy', 'term', 'credit_checks', 'verified_income_Source Verified', 'verified_income_Verified')

Best Model Adjusted R-squared: 0.19Step-wise selection: applied

Code

X = loans[['verified_income', 'debt_to_income', 'credit_util', 'bankruptcy', 'term', 'credit_checks', 'issue_month']]

y = loans['interest_rate']

X = pd.get_dummies(X, columns = ['verified_income', 'issue_month'], drop_first = True)

X.fillna(0, inplace=True)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42)

X_train_with_const = sm.add_constant(X_train)

X_test_with_const = sm.add_constant(X_test)

X_train_with_const = X_train_with_const.astype(int)

X_test_with_const = X_test_with_const.astype(int)

model = sm.OLS(y_train, X_train_with_const).fit()

model_summary2 = model.summary2()

print(model_summary2) Results: Ordinary least squares

==============================================================================

Model: OLS Adj. R-squared: 0.191

Dependent Variable: interest_rate AIC: 46653.7930

Date: 2024-04-25 15:09 BIC: 46723.6650

No. Observations: 8000 Log-Likelihood: -23317.

Df Model: 9 F-statistic: 210.4

Df Residuals: 7990 Prob (F-statistic): 0.00

R-squared: 0.192 Scale: 19.937

------------------------------------------------------------------------------

Coef. Std.Err. t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 4.0713 0.2319 17.5583 0.0000 3.6167 4.5258

debt_to_income 0.0330 0.0033 9.8715 0.0000 0.0265 0.0396

credit_util 3.0409 0.4077 7.4585 0.0000 2.2417 3.8401

bankruptcy 0.5811 0.1543 3.7659 0.0002 0.2786 0.8836

term 0.1445 0.0046 31.5795 0.0000 0.1356 0.1535

credit_checks 0.2122 0.0211 10.0534 0.0000 0.1708 0.2535

verified_income_Source Verified 1.0041 0.1150 8.7304 0.0000 0.7787 1.2296

verified_income_Verified 2.4460 0.1355 18.0457 0.0000 2.1803 2.7117

issue_month_Jan-2018 -0.0778 0.1254 -0.6204 0.5350 -0.3236 0.1680

issue_month_Mar-2018 -0.0178 0.1233 -0.1445 0.8851 -0.2596 0.2239

------------------------------------------------------------------------------

Omnibus: 762.745 Durbin-Watson: 1.958

Prob(Omnibus): 0.000 Jarque-Bera (JB): 1001.147

Skew: 0.820 Prob(JB): 0.000

Kurtosis: 3.562 Condition No.: 398

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is

correctly specified.Code

lr = LinearRegression()

# Initialize SequentialFeatureSelector (SFS) for forward selection

sfs = SFS(lr,

k_features = 'best', # Select the best number of features based on criterion

forward = True, # Forward selection

floating = False,

scoring = 'neg_mean_squared_error', # Using negative MSE as scoring criterion

cv = 0) # No cross-validation

# Fit SFS on the training data

sfs.fit(X_train, y_train)

# Get the names of the selected features

selected_features = list(sfs.k_feature_names_)

# Convert the DataFrame to numeric to ensure all features are numeric

X_train = X_train.apply(pd.to_numeric, errors='coerce').fillna(0)

X_test = X_test.apply(pd.to_numeric, errors='coerce').fillna(0)

# Select the features identified by forward selection

X_train_selected = X_train[selected_features]

# Fit the final Linear Regression model using selected features

final_model = lr.fit(X_train_selected, y_train)

# For AIC, BIC, and adjusted R-squared, use statsmodels

X_train_selected_with_const = sm.add_constant(X_train_selected)

# Ensure data type consistency

X_train_selected_with_const = X_train_selected_with_const.astype(float)

# Fit the OLS model

model_sm = sm.OLS(y_train, X_train_selected_with_const).fit()

# Output the results

print("Forward Selection Results")

print("Selected predictors:", selected_features)

print("AIC:", model_sm.aic.round(3))

print("BIC:", model_sm.bic.round(3))

print("Adjusted R-squared:", model_sm.rsquared_adj.round(3))Forward Selection Results

Selected predictors: ['debt_to_income', 'credit_util', 'bankruptcy', 'term', 'credit_checks', 'verified_income_Source Verified', 'verified_income_Verified', 'issue_month_Jan-2018', 'issue_month_Mar-2018']

AIC: 46034.53

BIC: 46104.402

Adjusted R-squared: 0.251Code

# Initialize the linear regression model

lr = LinearRegression()

# Initialize SequentialFeatureSelector (SFS) for forward selection

sfs = SFS(lr,

k_features = 'best', # Select the best number of features based on criterion

forward = False, # Forward selection

floating = False,

scoring = 'neg_mean_squared_error', # Using negative MSE as scoring criterion

cv = 0) # No cross-validation

# Fit SFS on the training data

sfs.fit(X_train, y_train)

# Get the names of the selected features

selected_features = list(sfs.k_feature_names_)

# Convert the DataFrame to numeric to ensure all features are numeric

X_train = X_train.apply(pd.to_numeric, errors='coerce').fillna(0)

X_test = X_test.apply(pd.to_numeric, errors='coerce').fillna(0)

# Select the features identified by forward selection

X_train_selected = X_train[selected_features]

# Fit the final Linear Regression model using selected features

final_model = lr.fit(X_train_selected, y_train)

# For AIC, BIC, and adjusted R-squared, use statsmodels

X_train_selected_with_const = sm.add_constant(X_train_selected)

# Ensure data type consistency

X_train_selected_with_const = X_train_selected_with_const.astype(float)

# Fit the OLS model

model_sm = sm.OLS(y_train, X_train_selected_with_const).fit()

# Output the results

print("Backward Selection Results")

print("Selected predictors:", selected_features)

print("AIC:", model_sm.aic.round(3))

print("BIC:", model_sm.bic.round(3))

print("Adjusted R-squared:", model_sm.rsquared_adj.round(3))Backward Selection Results

Selected predictors: ['debt_to_income', 'credit_util', 'bankruptcy', 'term', 'credit_checks', 'verified_income_Source Verified', 'verified_income_Verified', 'issue_month_Jan-2018', 'issue_month_Mar-2018']

AIC: 46034.53

BIC: 46104.402

Adjusted R-squared: 0.251Cross validation

Code

def best_subset_cv(X, y, max_features=5):

best_score = np.inf

best_subset = None

# Limiting the number of features for computational feasibility

for k in range(1, max_features + 1):

for subset in combinations(X.columns, k):

# Define the model

model = LinearRegression()

# Perform k-fold cross-validation

kf = KFold(n_splits = 5, shuffle = True, random_state = 42)

cv_scores = cross_val_score(model, X[list(subset)], y, cv = kf, scoring = 'neg_mean_squared_error')

# Compute the average score

score = -np.mean(cv_scores) # Convert back to positive MSE

# Update the best score and subset

if score < best_score:

best_score = score

best_subset = subset

return best_subset, best_score

# Start timing

start_time = time.time()

# Assuming X and y are already defined and preprocessed

best_subset, best_score = best_subset_cv(X, y)

# End timing

end_time = time.time()

# Calculate duration

duration = end_time - start_time

print("Best Subset:", best_subset)

print("Best CV Score (MSE):", best_score)

print("Computation Time: {:.2f} seconds".format(duration))Best Subset: ('credit_util', 'term', 'credit_checks', 'verified_income_Source Verified', 'verified_income_Verified')

Best CV Score (MSE): 18.664618422927752

Computation Time: 3.48 secondsCode

# Initialize the linear regression model

lr = LinearRegression()

# Initialize SequentialFeatureSelector for forward selection with cross-validation

sfs = SFS(lr,

k_features = 'best', # 'best' or specify a number with ('1, 10') for range

forward=True,

floating=False,

scoring = 'neg_mean_squared_error',

cv = KFold(n_splits = 5, shuffle = True, random_state = 42))

# Start timing

start_time = time.time()

# Fit SFS on the training data

sfs.fit(X, y)

# End timing

end_time = time.time()

# Calculate duration

duration = end_time - start_time

# Get the names of the selected features

selected_features = list(sfs.k_feature_names_)

print("Selected predictors (forward selection):", selected_features)

print("Computation Time: {:.2f} seconds".format(duration))Selected predictors (forward selection): ['debt_to_income', 'credit_util', 'bankruptcy', 'term', 'credit_checks', 'verified_income_Source Verified', 'verified_income_Verified']

Computation Time: 0.62 secondsCode

# Convert the DataFrame to numeric to ensure all features are numeric

X_train = X_train.apply(pd.to_numeric, errors = 'coerce').fillna(0)

X_test = X_test.apply(pd.to_numeric, errors = 'coerce').fillna(0)

# Select the features identified by forward selection

X_train_selected = X_train[selected_features]

# Fit the final Linear Regression model using selected features

final_model = lr.fit(X_train_selected, y_train)

# For AIC, BIC, and adjusted R-squared, use statsmodels

X_train_selected_with_const = sm.add_constant(X_train_selected)

# Ensure data type consistency

X_train_selected_with_const = X_train_selected_with_const.astype(float)

# Fit the OLS model

model_sm = sm.OLS(y_train, X_train_selected_with_const).fit()

# Model results

model_summary2 = model_sm.summary2()

print("Forward selection best fit:\n")

print(model_summary2)Forward selection best fit:

Results: Ordinary least squares

============================================================================

Model: OLS Adj. R-squared: 0.251

Dependent Variable: interest_rate AIC: 46030.6466

Date: 2024-04-25 15:09 BIC: 46086.5442

No. Observations: 8000 Log-Likelihood: -23007.

Df Model: 7 F-statistic: 384.2

Df Residuals: 7992 Prob (F-statistic): 0.00

R-squared: 0.252 Scale: 18.448

----------------------------------------------------------------------------

Coef. Std.Err. t P>|t| [0.025 0.975]

----------------------------------------------------------------------------

const 2.1781 0.2216 9.8311 0.0000 1.7438 2.6125

debt_to_income 0.0214 0.0032 6.5925 0.0000 0.0150 0.0277

credit_util 4.7592 0.1794 26.5247 0.0000 4.4075 5.1109

bankruptcy 0.4028 0.1486 2.7109 0.0067 0.1115 0.6940

term 0.1493 0.0044 33.8811 0.0000 0.1406 0.1579

credit_checks 0.2238 0.0203 11.0250 0.0000 0.1840 0.2636

verified_income_Source Verified 0.9396 0.1106 8.4934 0.0000 0.7228 1.1565

verified_income_Verified 2.5107 0.1304 19.2581 0.0000 2.2551 2.7663

----------------------------------------------------------------------------

Omnibus: 908.105 Durbin-Watson: 1.953

Prob(Omnibus): 0.000 Jarque-Bera (JB): 1279.631

Skew: 0.884 Prob(JB): 0.000

Kurtosis: 3.843 Condition No.: 242

============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is

correctly specified.Conclusions

OLS regression is a great baseline model to compare against

Falls victim to collinearity, overly complex models

- Hence selection methods with model assessment

Best subset selection can overfit easier than stepwise selection

Stepwise selection is faster

Stepwise inflates Type I error with multiple testing…

Live coding: Indoor air pollution

| variable | class | description |

|---|---|---|

| Entity | character | Country name |

| Code | character | Country code |

| Year | double | Year |

| access_clean_perc | double | Access to clean fuels and technologies for cooking (% of population) |

| variable | class | description |

|---|---|---|

| Entity | character | The country |

| Code | character | Country code |

| Year | double | Year |

| access_clean_perc | double | % of population with access to clean cooking fuels |

| GDP | double | GDP per capita, PPP (constant 2017 international $) |

| popn | double | Country population |

| Continent | character | Continent the country resides on |

| variable | class | description |

|---|---|---|

| Entity | character | The country |

| Code | character | Country code |

| Year | double | Year |

| Death_Rate_ASP | double | Cause of death related to air pollution from solid fuels, standardized |

Live coding

Code

from sklearn.impute import SimpleImputer

from feature_engine.imputation import CategoricalImputer

# Read in data

fuel_access = pd.read_csv('data/fuel_access.csv')

fuel_gdp = pd.read_csv('data/fuel_gdp.csv')

death_source = pd.read_csv('data/death_source.csv')

# Select relevant columns and rename for consistency if needed

fuel_access = fuel_access[['Entity', 'Year', 'access_clean_perc']]

fuel_gdp = fuel_gdp[['Entity', 'Year', 'GDP', 'popn']]

death_source = death_source[['Entity', 'Year', 'Death_Rate_ASP']]

# Ensure 'Year' is an integer

fuel_access['Year'] = fuel_access['Year'].astype(int)

fuel_gdp['Year'] = fuel_gdp['Year'].astype(int)

death_source['Year'] = death_source['Year'].astype(int)

# Merge datasets on 'Entity' and 'Year'

merged_data = pd.merge(fuel_access, fuel_gdp, on = ['Entity', 'Year'], how = 'inner')

merged_data = pd.merge(merged_data, death_source, on = ['Entity', 'Year'], how = 'inner')

# Check for missing values

print(merged_data.isnull().sum())

# Handle missing values if necessary (e.g., fill with mean or median, or drop)

num_imputer = SimpleImputer(strategy = 'mean') # or 'median'

numerical_cols = merged_data.select_dtypes(include = ['int64', 'float64']).columns.tolist()

merged_data[numerical_cols] = num_imputer.fit_transform(merged_data[numerical_cols])

merged_data.dropna()

merged_data['Entity'] = pd.factorize(merged_data['Entity'])[0]

# Final check for data types and missing values

print(merged_data.info())

print(merged_data.isnull().sum())

# Optional: Standardize/normalize numerical columns if necessary

from sklearn.preprocessing import StandardScaler

scaler = StandardScaler()

numerical_columns = ['access_clean_perc', 'GDP', 'popn']

merged_data[numerical_columns] = scaler.fit_transform(merged_data[numerical_columns])

merged_data.to_csv()

# Define the predictor variables and the response variable

X = merged_data.drop(['Death_Rate_ASP'], axis = 1) # Assuming 'Death_Rate_ASP' is the response variable

y = merged_data['Death_Rate_ASP']

# Split the data into training and testing sets

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.2, random_state = 42)

# Initialize LinearRegression model

lr = LinearRegression()

# Initialize SequentialFeatureSelector for forward selection with cross-validation

sfs = SFS(lr,

k_features = 'best', # 'best' or specify a number with ('1, 10') for range

forward = True, # Forward selection

floating = False, # Set to True for stepwise selection

scoring = 'neg_mean_squared_error', # Using negative MSE as scoring criterion

cv = KFold(n_splits = 5, shuffle = True, random_state = 42)) # 5-fold cross-validation

# Fit SFS on the training data

sfs.fit(X_train, y_train)

# Get the names of the selected features

selected_features = list(sfs.k_feature_names_)

# Fit the final Linear Regression model using selected features

final_model = lr.fit(X_train[selected_features], y_train)

# Evaluate the model performance on the test set

from sklearn.metrics import mean_squared_error

y_pred = final_model.predict(X_test[selected_features])

mse = mean_squared_error(y_test, y_pred)

print("Selected predictors (forward selection):", selected_features)

print("Test MSE:", mse)

# Extracting predictor variables (X) and the target variable (y)

X = merged_data[selected_features]

Y = merged_data['Death_Rate_ASP']

# Adding a constant for the intercept term

X = sm.add_constant(X)

# Fit the regression model

model = sm.OLS(y, X).fit()

model_summary = model.summary2()

print(model_summary)